News and events

This workshop will bring together experts in mathematics, statistics, and environmental studies to explore the challenges and opportunities of climate change. The workshop will be hosted in The Institute of Statistical Mathematics (ISM) in Tokyo, Japan during 21st - 23rd November 2023. It is organised jointly by ISM, University College London, University of California Santa Barbara, and Macquarie University Centre for Risk Analytics.

Click here for more information and registration..

Professor Harrison Hong of Columbia University Department of Economics will visit the Centre for Risk Analytics on 17 November 2023. As part of his visit, he will present a seminar "Extreme-Weather Risks in a Changing Climate: Implications of Learning and Adaptation for Panel Models" at 11am-12pm in Seminar Room 623, Level 6, 4 Eastern Road, MQBS.

Professor Harrison Hong will present a CRA seminar “Extreme-Weather Risks in a Changing Climate: Implications of Learning and Adaptation for Panel Models” on 17 November 2023 from 11 am to 12 pm at Macquarie University Business School, Seminar Room 623, Level 6, 4 Eastern Road, MQBS. The seminar can also be attended online via Zoom.

Abstract

The adverse consequences of global warming for extreme weather are uncertain. Damages should vary as society learns about them from extreme-weather arrivals and adapts. Using country-level data on tropical cyclones and temperature, we find that unexpected extreme-weather arrivals damage growth, elevate the risk of subsequent strikes, and increase costly adaptation. To fit these findings, we estimate a panel model where damage falls with Bayesian posteriors of extreme-weather arrivals. We decompose damage into a portion with adaptation fixed at priors and a correction for a change in adaptation with revision of priors. Panel-model projections of damages ignoring learning are significantly biased.

Prof. Harrison Hong bio

Harrison Hong is the John R. Eckel Jr. Professor of Financial Economics at the Columbia University Department of Economics and Executive Director of the Program for Economic Research. Before coming to Columbia in 2016, he was on the economics faculty of

Princeton University, most recently as the John Scully ’66 Professor of Economics and Finance. Prior to that, he was an associate professor of finance at the Stanford Graduate School of Business from 1997- 2001. He received his B.A. in economics and statistics with highest distinction from the University of California at Berkeley in 1992 and his Ph.D. in economics from M.I.T. in 1997. In 2009, he was awarded the Fischer Black Prize, given once every two years to the best American finance economist under the age of 40. He received honorary doctorates from Stockholm School of Economics and Aalto University and is a past Director of the American Finance Association. He is a research associate at the National Bureau of Economic Research and an academic advisor at LSV Asset Management. He has contributed to a number of areas in financial economics, including stock market efficiency, behavioral finance, and climate finance. His recent work focuses on the role of the financial system in addressing climate change. He is a co-author on the upcoming Fifth National Climate Assessment for the US Congress and an advisor on several climate risk assessments by the International Monetary

Fund.

The de-carbonisation of the economy involves significant changes to the current structure of energy markets, the creation and design of new markets for carbon credit units, and the integration of new energy sources, such as hydrogen, into these markets. This has significant implications for the energy industry, but also the financial sector and entire economy. While the energy transition poses significant risks to incumbents, it also provides many opportunities for investment into new technologies, as well as the creation of new financial products and markets.

The 2023 Financial Risk Day examined risks, opportunities and solutions for the transition of energy markets and the de-carbonisation of the economy. Experts from industry, regulation and academia discussed existing and new ideas on how to facilitate a smooth transition, the impacts of the transition on energy markets, financial institutions, and the economy as a whole.

Please visit our Financial Risk Day website for further information.

The Centre for Risk Analytics and Food Next Door invite you to celebrate the successful delivery of the project Food Moves Skills into Migrant Women. In this event we bring together researchers from Macquarie University, government stakeholders, industry partners, funding bodies and project participants who have contributed to the successful completion of this pilot program. The event aims to share the transition journey of African women who participated in the program to acquire financial literacy, social enterprise, and leadership skills.

The Food Moves Skills into Migrant Women project was conducted over a period of two years with the aim of having a significant impact on the lives of African women with refugee background residing in regional Australia. With the generous support of Ecstra Foundation through its Women’s Economic Security Project Grants program, the program focussed on:

- Creating and providing culturally appropriate Financial Literacy training in co-creation with the participants.

- Creation of mentorship manuals and resources to refugees on sustainability leadership

- Mentoring on project management skills and social enterprise business creation.

- Creating a culturally safe space for developing leadership, social enterprise, and financial management skills.

We hope you will be able to join us to hear about the transition journey from mentees to mentors and to learn about resources that have been created in the program.

The event will be an opportunity for researchers, program alumni, philanthropy bodies, government and community stakeholders to connect, celebrate and hear about impactful strategies to address financial literacy, leadership and sustainable food systems for regional populations.

There is no registration fee for the event, however we ask participants to register for catering purposes.

For any further details about the event please contact Dr Fabiola Barba Ponce, Centre for Risk Analytics: fabiola.barba-ponce@mq.edu.au

Date: Thursday 3 August 2023

Time: 5.30pm - 7.30pm

Venue: Macquarie University City Campus

Angel Place, Level 24, 123 Pitt Street, Sydney

RSVP by 5pm, Tuesday 1 August

RSVP by 5pm, Tuesday 1 August 2023

Register here.

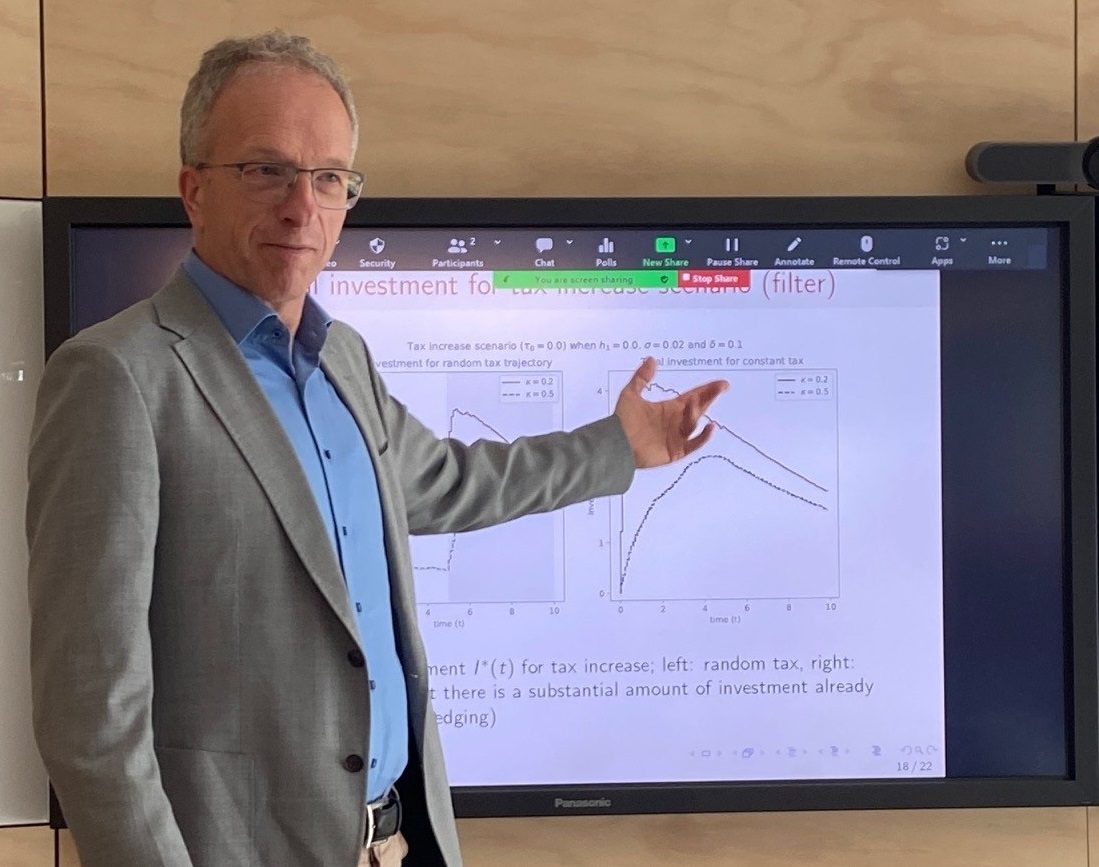

Professor Rüdiger Frey of the Vienna University for Economics and Business will visit the Centre for Risk Analytics on 29 May 2023. As part of his visit, he will present a seminar "Steady does it? On the impact of tax uncertainty on investment into carbon abatement technologies" at 11am-12pm in Finance Decision Lab MQBS.

Professor Rüdiger Frey will present a CRA seminar “Steady does it? On the impact of tax uncertainty on investment into carbon abatement technologies” on 29 May 2023 from 11 am to 12 pm at Macquarie University Business School, 110 Finance Decision Lab, Level 1, 4 Eastern Rd. The seminar can also be attended online via Zoom.

Abstract

Carbon taxes and emissions trading are a key policy tool for reducing carbon emissions. Most of the economics literature focuses on the structure of optimal taxes or optimal supply of emission certificates. However, in reality future emission tax rates are somewhat random since they are affected by unpredictable events such as political sentiment or the outcome of elections. This is a special case of so-called climate policy uncertainty.

In this talk we study the problem of a profit maximizing electricity producer who decides on investments in technologies for abatement of CO2 emissions in an environment with random emission taxes. We compare two scenarios: in the first scenario, the taxation policy is deterministic; in the second scenario we allow for exogenous deviations from the deterministic setting, which arrive at exponential times, which may either increase or decrease the taxes. We show that in certain scenarios the uncertainty on the future taxation makes the company less willing to make investment and hence a clear and a priori fixed strategy would instead maximize the actions for emission reduction.

Prof. Rüdiger Frey bio

Rüdiger Frey is Full Professor of Mathematics and Finance at the Vienna University for Economics and Business (WU). Prior to that he held positions as Professor of Optimization and Financial Mathematics at the University of Leipzig and various academic positions at the University of Zurich and at the Federal Institute of Technology (ETH) in Zurich. He holds a diploma in mathematics from the University of Bonn where he received his PhD in financial economics in 1996. His main research fields are quantitative risk management, dynamic credit risk models, the pricing and hedging of derivatives under market frictions and optimization problems in financial economics. Rüdiger has published research papers in leading international academic journals and has given seminars at a number of important international conferences and institutions. He is moreover frequently giving practitioner courses. Rüdiger is coauthor of the popular book "Quantitative Risk Management: Concepts Techniques & Tools" (Princeton University Press 2015).

Professor Uwe Schmock of Vienna University of Technology will visit the Centre for Risk Analytics and ASBA from 4-27 January 2023. As part of his visit, he will present a seminar on "Recursive Methods for the Aggregation of Dependent Risks" on Friday 13 of Jan 2023, at Actuarial Research Day, at 11:50 am – 12:30 pm at Macquarie City Campus located at Level 24, 123 Pitt Street Sydney, NSW 2000.

Register for the event and to see the complete program on this link.

Professor Uwe Schmock will also present an ASBA seminar “Testing for Stochastic Dependence” on 18 January from 2 pm to 3 pm at Macquarie University Business School room 4ER-723-Executive Meeting Room.

A mini-course for HDR titled "Selected Results of Stochastic Analysis for Financial and Actuarial Mathematics" will be held on the 25th of January from 10 am to 4 pm in the Finance Decision Lab, Macquarie University (4 Eastern Rd, North Ryde). RSVP for catering purposes on this link.

And also in zoom https://macquarie.zoom.us/j/81858954862

Prof. Uwe Schmock bio

Since 2003 Dr. Uwe Schmock is full professor at the Vienna University of Technology (TU Wien) in Austria, heading the research area for risk management in financial and actuarial mathematics. TU Wien is currently the only institution in Austria offering all the courses to become a fully qualified actuary. He is also serving as vice president of the Actuarial Association of Austria and as chairman of its educational committee for more than a decade.

After his PhD at TU Berlin, he spent 13 years at the University and the ETH Zürich in various positions. As Research Director of the Swiss RiskLab at ETH Zürich, he worked with his team on projects together with the two major Swiss banks (Credit Suisse, UBS) and with Swiss Re. As Director he built up the program for the Master of Advanced Studies in Finance, offered jointly by the University and ETH Zürich ever since.

At TU Wien, he attracted funding from the Austrian Central Bank, the European Science Foundation, the Austrian Science Foundation, the Vienna Science and Technology Fund, the Anniversary Fonds of the Austrian Central Bank, etc. His major project was the Christian Doppler Laboratory for Portfolio Risk Management, which he was running as director for 8 years. The laboratory was cooperating with industry partners (Bank Austria, Austrian Federal Financing Agency, Austrian Control Bank, and a consulting company), working on basic as well as applied research.

Dr. Schmock is committed to teaching. Besides his usual teaching obligations, he taught three summer courses for international students in Italy, had several teaching assignments at the University of Basle (Switzerland), the University of Strasbourg (France) and holds a Guest Professorship at the University of Salzburg (Austria) with regular teaching assignments. So far he supervised 11 PhD students.

In recent decades, processes in the financial system have become increasingly more digitalized, relying critically on the confidentiality and integrity of data and systems, and resilient communications technology infrastructure. Financial institutions, market participants, and regulators are required to carefully consider the risks of disruptions through cyber incidents. In recent decades, such incidents have become more frequent and increasingly costly and damaging.

The 2022 Financial Risk Day examined recent developments in the financial sector with regard to cyber-related risks. The welcome address was given by Professor Leonie Tickle, Deputy Dean Research and Innovation of Macquarie Business School. Then experts from industry, regulation and academia discussed how to appropriately identify, measure and manage cyber threats and how to develop solutions to enhance cyber security in the financial industry.

A regulatory view on cyber risk and resilience to cyber threats in the financial industry was shared by Rachel Howitt (ASIC) and John Singh (APRA). Alberto Piccenna (AON) and Quinton Kotze (Chubb) gave presentations on assessing cyber-related risks in the evolving cyber threat landscape from the perspective of the insurance sector. Richard Johnson (Westpac) shared insights on cyber risk management from the banking industry and how a coordinated defence and collaboration can become a cornerstone in cyber security. Prof Dali Kaafar (Executive Director of Macquarie University Cyber Security Hub) gave a talk on privacy preservation methods.

During a cybersecurity showcase session, presented by researchers of Macquarie University’s Centre for Risk Analytics, Prof Zhuo Jin, Prof Stefan Trueck and Prof Pavel Shevchenko provided insights on their recent projects in the area of cyber risk management.

A panel discussion on Cyber Security: Financial Risks and Solutions was moderated by David Orsmond, Professor of Economics at Macquarie Business School. Panel discussants included Richard Johnson (Westpac), Alberto Piccenna (AON) and John Singh (APRA).

Closing remarks by the Co-Director of the Centre for Risk Analytics, Professor Pavel Shevchenko were followed by a cocktail reception at the end of the event. Please visit our Financial Risk Day website for further information.

The 4th Australasian Commodity Markets Conference was held on April 7-8, 2022. The conference was dedicated to high-quality research in all areas of economics and finance related to commodities, with an emphasis on the Australasian aspects of commodity and energy markets. For the first time the conference was held in a hybrid format, combining in-person attendance and presentations with the option to also participate online.

This year’s academic Keynote Speakers were Professor Dirk Baur from University of Western Australia, as well as Professor Tom Smith and Professor Vladimir Strezov from Macquarie University. Themes of the keynote presentations included the relationship between the price of gold and bitcoin (Baur), political connections and the transition to low-carbon sources in China (Smith) and the use of biomass for energy generation from a sustainability perspective (Strezov). Plenary presentations from industry included a talk on ‘The Transition of the Australian National Electricity Market’ by Sal Tringali (Head of C&I, Snowy Hydro) and on ‘Emerging Dislocations in Energy Markets’ by Daniel Hynes (Senior Commodity Strategist, ANZ).

Over two days more than 40 delegates took part in parallel streams of themed talks and workshops. Topics covered by academic speakers covered a diverse spectrum of commodity-related topics, ranging from the behaviour of commodity markets, carbon pricing, the transition of electricity markets, issues related to renewable energy, mathematical and quantitative models, risk management, and uncertainty in commodity markets.

The conference was organised by the Centre for Risk Analytics with Lurion de Mello and Stefan Trueck as conference chairs, and Rohan Best, Lin Han, John Inekwe, Marjan Nazifi, Pavel Shevchenko and Chi Truong as members of the organizing committee.

The Centre for Risk Analytics Fellows, Dr Matteo Malavasi and Dr Fabiola Barba Ponce were shortlisted as two of Macquarie University’s best twelve researchers. They participated in the Early Career Researcher Showcase held yearly at Macquarie University. Both had only five minutes to present their research to an esteemed judging panel and the event’s audience.

The event was opened by Professor Sakkie Pretorius, Deputy Vice-Chancellor (Research) and had VIP guests including Professor Eric Knight, Executive Dean of Macquarie Business School, Professor Martina Möllering, Executive Dean of Faculty of Arts and Professor Magnus Nyden, Executive Dean of the Faculty of Science and Engineering in attendance. And special guest speaker Distinguished Professor of Biology and ECR Network lead, Lesley Hughes, Pro Vice-Chancellor (Research Integrity and Development).

Dr Fabiola Barba Ponce’s project is an industry-research funded project supported by Ectra Foundation and deliver in collaboration with Food Next Door and the Co-op Federation. This applied research develops African migrant leadership, social and economic integration through developing regenerative farming and food-related business in regional Victoria and NSW. Angie Kelly, the editor of The Lighthouse publication, called Dr Barba Ponce’s presentation this year’s Impact Award Runner up for the potential impact her research can have on media.

Dr Matteo Malavasi’s project "Quantification of Cyber Risk and Its Driving Risk Factors", is in partnership with Optus Macquarie University Cyber Security Hub. This project focuses on the development of actuarial models for the quantification of cyber risk losses and the identification of key risk factors. The project will quantify appropriate models for the frequency and severity of cyber risk losses and their dependence on risk indicators such as quality of software systems, transaction volume, country, company size available in the analysed dataset.

Click here for the event's recording of Dr Malavasi and Dr Barba Ponce's presentations

Click here for more information on the Early Career Research showcase

Cyber-criminals target Australians’ mobile phones, because businesses (e.g. online banking, superannuation funds, email and social media providers) commonly use SMS messages for two-factor authentication of their customers’ identity. Unauthorised mobile phone porting attacks enable cyber-criminals to impersonate their victims and gain control over their online accounts to steal their money, reset their passwords, apply for credit in their victim’s name, etc., because the criminals receive the two-factor authentication SMS code rather than the victim. Unfortunately, most consumers are not aware of this risk. Mobile phones were by far the most prevalent delivery technique among the 20,000 identity theft incidents reported in 2020 according to the Australian Competition and Consumer Commission (ACCC).

Combining multidisciplinary research in cyber security, risk management and behavioural psychology, Professor Stefan Trueck, Dr John Selby, Dr Fabiola Barba Ponce, and Professor Christophe Doche created and launched the SIMProtect Project. SIMProtect aims to improve the social welfare and individual wellbeing of Australians by raising awareness and better protecting consumers from the risks of fraudulent mobile number porting and identity theft.

On May 26th 2021 at the Macquarie City Campus, the research team launched the three major outputs of the project: an innovative website, an interactive online game, and an educational video. The project also involves a social media campaign to raise awareness in the Australian community about the risks of mobile number porting and identity theft.

The event was attended by the public, journalists from various media outlets and key members of the project’s main partners and funding bodies, the Ecstra Foundation, a not-for-profit organisation committed to improving the financial wellbeing of all Australians, the Optus Macquarie University Cyber Security Hub and Macquarie Business School.

Since its launch, the project has already educated over 50,000 Australians about mobile number porting risks, while the SIMProtect website continues to attract more than 2,000 Australian visitors per week.

CFR Members were awarded $1.05m in ARC Discovery Grants in November 2018, to be shared between three diverse projects on financial risk that range from predicting housing price changes to an emerging field in quantitative finance.

Associate Professor Roselyne Joyeux, Associate Professor George Milunovich, Associate Professor Shuping Shi and Dr Ben Wang are part of a team that has received $220,000 to measure uncertainty in global housing markets and the risk to Australia.

The project aims to develop and construct a measure of systemic risk for national real-estate markets in Australia, and its main trading partners; China, Japan, New Zealand, United Kingdom and US. It will investigate how real estate risks migrate geographically over time and during periods of financial turbulence.

Early detection of the onset of future housing bubble collapses would be of significant benefit to policy makers, Australia’s trading partners, the real estate industry and ultimately home buyers. New methodology has been developed and is intended to become part of a market stability surveillance program that can assess the impact of real-estate risk on the overall economy.

In a second ARC Discovery Grant, CFR member Professor Ken Siu has received $450,000 to establish a novel field: Two-price quantitative finance, and explore its applications. The new field will integrate two major schools for modelling and explain the presence of two prices, the buying and selling prices, widely observed in real-world markets, and the equilibrium approach from the fundamental law of one price.

The aim of the project is to deepen the understanding of fundamental relationships between liquidity, prices, risk and the economy. It is expected to make a long-term impact on quantitative finance and related applications through providing a deep understanding of, and a new perspective for, the design, risk and fairness of finance, property and insurance markets.

The third project is an ARC Discovery Early Career Researcher Grant (DECRA) that has been awarded to Associate Professor Shuping Shi for monitoring financial bubbles using high-frequency data. This project, which received $375,000, aims to develop an econometric procedure for monitoring speculative behaviour, often labelled as bubbles, in financial markets.

Financial speculation can inflict harm on the real economy, and crises or recessions are often preceded by excessive asset market speculation. The project will utilise intraday information for bubble detection and address major technical challenges arising from high-frequency financial data.

It is expected to significantly improve the speed and accuracy of bubble detection which will provide more timely and precise warning alerts for investment decisions, market surveillance and policy action, enhancing risk management tools in the economy.

Policymakers and investors are increasingly recognising the important implications of climate change for the financial industry. As a result, industry and government are required to carefully consider their climate change risk management and develop a range of options and policies, as well as an effective regulatory framework. The 10th annual Financial Risk Day had a focus on these core issues as well as other themes related to the impacts of climate change risks and opportunities for the financial industry.

The welcome address was given by Professor Amanda Barnier, Pro-Vice-Chancellor at Macquarie University. In his keynote speech, Brad Archer, the Chief Executive Officer of the Climate Change Authority highlighted the opportunities and risks of climate change for the economic landscape in Australia. A regulatory perspective on climate change disclosure and governance was then shared by Claire LaBouchardiere, who is a Senior Executive Leader at the Australian Securities and Investments Commission.

A panel discussion on financial risks and opportunities related to climatic change was moderated by David Orsmond, Professor of Economics at Macquarie Business School. Panellists included Brad Archer, Claire LaBouchardiere, Rade Musulin, a Principal at Finity Consulting, and Professor Martina Linnenluecke from Macquarie University’s Centre for Corporate Sustainability and Environmental Finance.

The afternoon session included presentations by Rade Musulin on the role insurance can play in managing climate risk, by Richard Matear, Chief Research Scientist at CSIRO Oceans and Atmosphere, on how climate science can help to inform the financial industry and risk management, by Stefan Trück, Professor of Business Analytics at Macquarie Business School on company’s voluntary carbon disclosures, and Graham Sinden, Head of Climate Risk at APRA, who addressed climate risk and its impact on the Australian finance sector.

Closing remarks by the three Co-Directors of the Centre for Risk Analytics, Professor Jeffrey Sheen, Professor Pavel Shevchenko and Professor Stefan Trück were followed by a cocktail reception at the end of the event. Please visit our website for further information as well as some of the presentation slides from this years’ Financial Risk Day.

Professor Christiane Baumeister of University of Notre Dame, Indiana will visit the Centre for Risk Analytics 9-13 March 2020.

As part of her visit, she will present a seminar on "Energy Markets and Global Economic Conditions" on Wednesday 11 March, in conjunction with the Department of Economics, at 11am – 12pm in 4ER 623.

Professor Baumeister’s presentation will evaluate alternative indicators of global economic activity and other market fundamentals in terms of their usefulness for forecasting real oil prices and global petroleum consumption. While world industrial production is regarded as one of the most useful indicators, she also considers how combining measures from different sources can give an even better indication. The analysis reveals a new index of global economic conditions and new measures for assessing future tightness of energy demand and expected oil price pressures.

During her five day visit, Professor Baumeister will also hold consultation sessions for staff members and HDR students seeking input by MRes and PhD students from the Department of Economics, Applied Finance, and Actuarial Studies and Business Analytics into their work and on future research collaborations.

Professor Baumeister is the Robert and Irene Bozzone Associate Professor of Economics at the University of Notre Dame, Indiana. She holds, or has held, other positions as NBER Faculty Research Fellow, CEPR Research Fellow, CESifo Research Network Affiliate, Research Fellow, Halle Institute for Economic Research and Research Professor, Deutsche Bundesbank Research Center. She completed her PhD at Ghent University.

Before joining the Economics Department at Notre Dame in 2015, Christiane Baumeister was a Principal Researcher in the International Economic Analysis Department at the Bank of Canada. Her research interests include empirical macroeconomics, energy economics, applied time series econometrics and monetary economics.

She has published scholarly articles in a number of journals including Econometrica, the American Economic Journal: Macroeconomics, the International Economic Review, the Journal of Business and Economic Statistics and the Journal of Applied Econometrics. She is a Research Affiliate at the Centre for Economic Policy Research and has been a visiting research scholar at the International Monetary Fund, the Banque de France, the University of California at San Diego, and the NIPE Research Center in Economics.

Prof Luetkepohl, who specialises in time series analysis, will work with Associate Professor George Milunovich on a research collaboration, along with others from the Centre for Risk Analytics, the Department of Actuarial Studies and Business Analytics and the Department of Economics during his visit.

He will also present a seminar on Wednesday 4 March on ‘Testing Identification via Heteroskedasticity in Structural Vector Autoregressive Models’. The seminar will address tests for identification through heteroskedasticity in structural vector autoregressive analysis developed for models with two volatility states where the time point of volatility change is known.

The seminar will be held in E4R 523, starting at 10.30am for morning tea, before the seminar presentation at 11am.

Professor Luetkepohl has a professorial position at Freie Universität Berlin and the DIW Graduate Center, Berlin since 2012. He is and has been Associate Editor of a number of journals such as Econometric Theory, Journal of Econometrics, the Journal of Applied Econometrics, Macroeconomic Dynamics, Empirical Economics and Econometric Reviews.

He has published extensively in leading field journals and books and is author, co-author and editor of a number of books in econometrics and time series analysis. For example, he has authored an 'Introduction to Multiple Time Series Analysis' (Springer, 1991) and a 'Handbook of Matrices' (Wiley, 1996). His current teaching and research interests include methodological issues related to structural vector autoregressive modelling. Professor Luetkepohl last visited Macquarie University in 2016.

In an analysis of more than 800 speeches presented by the presidents of the European Central Bank and the Bundesbank, differences in communication strategies and divergence of tone on monetary policy are considered with their implications for shocks and interest rate responses.

Prof Tillmann has undertaken extensive research on how changing communication methods, such as Twitter, have been impacting on financial markets globally in unprecedented ways.

In his seminar presentation he will examine closely ongoing conflict between the presidents of the ECB and Bundesbank who largely control monetary policy in the euro area, and how differences in their communication approach can influence the expectation component of long-term interest rates.

Prof Tillmann has observed that ECB communication about monetary policy is persistently more positive than the Bundesbank, but when there is cacophonous communication from the two bodies there can be muted adjustments from financial markets in some circumstances.

His seminar will be held on Wednesday 25 September from 10.30am – 12pm, with morning tea included, in room 623 of 4 Eastern Road.

The workshop, on 6 May 2019, focused on key results from a joint research project between ADB and a team of researchers from Macquarie Business School including Chi Truong, Jeffrey Sheen and Stefan Trueck. Attendants included a wide range of researchers and Higher Degree Research Students from the Department of Economics, Applied Finance, and Actuarial Studies and Business Analytics.

The workshop started with a presentation by Mr James Villafuerte (ADB) on the economic outlook and key risks for the world economy and the Asian region. According to Mr Villafuerte’s presentation, the global economy is forecast to continue to slow down in the next couple of years, with the growth of major industrial economies expected to reduce from 2.2% in 2018 to 1.9% in 2019 and 1.6% in 2020. This is mainly due to the decrease in global trade caused by tensions between major economies such as the US and China. In Asia, an economic slowdown is predicted for the majority of countries, with the economic growth of China predicted to decrease from 6.6% in 2018 to 6.3% in 2019 and 6.1% in 2020.

Main sources of risk include US-China trade tension, increasing leverage, a so-called hard Brexit, and other policy uncertainty. Trade policy uncertainty has increased to a record high level in January 2019, and the trade growth for ASEAN, China and Japan has slowed down, reaching negative territory in January 2019. Nevertheless, financial stress has stayed at a relatively low level, indicating that the market is not expecting a crisis soon. However, sudden movements of financial stress in the past suggest that it is important to closely monitor financial vulnerability.

Mr Villafuerte also pointed out that the ADB currently uses an Early Warning System model that was developed in 2000 for currency and banking crises, based on 45 economic and financial indicators. Although the model is useful in keeping policy makers vigilant about systemic risk, its drawbacks include sending too much noise and failing to capture the GFC. Also, its focus was on currency crisis, while key vulnerabilities have shifted to other areas. One of the key objective of the project conducted jointly with research from MQ was to improve the Early Warning System used by the ADB.

Dr Chi Truong then presented the results of the ADB-MQ project on a new Early Warning System. Dr Truong pointed out that the new framework has been developed based on the original ADB model, but introduced several new features. First, the new framework defines crises based on a financial stress index that can capture currency crises, banking crises, debt crises and financial crises. Second, a macro-finance dynamic factor model is used to summarize the information from a big, unbalanced and mixed frequency data set into four indices. This helps to capture not only information from domestic economic and financial variables, but also information from global economic and financial indicators.

The model is particularly useful in that it allows to capture information from frequently updated financial variables such as the prices of credit default swaps, and the default risk of major banks. Dr Truong pointed out that when testing the model, in-sample results suggest that the derived indicators provide additional explanatory power compared to standard indicators used in the original ADB model. He also emphasized that the new model yields a relatively high proportion of correct predictions, at the same time having a low noise to signal ratio in the out-of-sample test. Overall, the developed model provides a new milestone in crisis prediction for Asian economies and will be implemented by the ADB to monitor these risks in several countries in the near future.

The presentation on Friday 4 November considered recent changes in the processes involved in supplying gas for export from Russia and the implications for other gas exporting countries, especially Australia.

Dr Bros has worked in the energy field for more than 20 years, involved with both policy and trading. He launched the European gas and power research arm for Société Générale in 2011. He is recognised as a leader in the energy industry sector having been credited as best European gas analyst for four years in a row (2013-2016) based on the broad range of strategic issues covered.

Dr Bros is a member of the EU-Russia Gas Advisory Council and an advisor for the World Energy Council - Global Gas Centre. He is also a visiting professor at SciencesPo Paris, a senior research fellow at Oxford University, a senior expert at Energy Delta Institute, an Advisory Board Member for the Research Center for Energy Management (ESCP Europe) and a visiting lecturer at IFP School.

Thierry Bros has a Master of chemical engineering from ESPCI ParisTech and a PhD from Ecole Centrale Paris.

The visit was hosted by Centre for Financial Risk member Rosalyne Joyeux from the Department of Economics.

Keynote speaker Professor Ehud Ronn, University of Texas at Austin, began the conference with his presentation on A Financial-Economics Approach to Forecasting Crude-Oil Spot Prices.

The morning plenary session of the first day also included Dr Richard Matear, CSIRO, on the development of a climate analysis modelling system. This project was discussed further by Vassili Kitsios, CSIRO, on the second day of the conference, where he expanded on the use of the model for decision-making on climate-exposed investments.

Speakers at the Commodity Markets Conference ranged from academics, early career researchers, industry representatives, regulators and journalists. Topics covered a diverse spectrum of commodity-related topics, ranging from commodity price behaviour, carbon bubbles, renewable energy issues, mathematical modelling and the impact of developments in China on commodities as a consequence of the belt and road project.

Over two days the 50 delegates took part in three streams of themed talks and workshops, coming together for informal interaction at the conference dinner, held at the Little Snail French restaurant in Darling Harbour on Thursday evening.

The conference was organised by committee members Lurion de Mello, Stefan Trueck, Abhay Singh and Pavel Shevchenko with most speakers also involved in the program as session chairs or discussants to ensure a dynamic approach and robust critical analysis of the papers presented.

Michael Rice, CEO of Rice Warner discussed the changing role of the age pension in retirement and ways that adjustments to government policy and superannuation can be used to enhance outcomes for more people.

Australian Government Actuary at the Commonwealth Treasury, Guy Thorburn, examined ways of managing risks for retirees, while David Knox, Senior Partner and Senior Actuary at Mercer, considered the changing needs of retirees and how both government and industry might respond.

Michael Sherris, Professor of Actuarial Studies, UNSW analysed the links between health status and functional disability with applications for life annuities and long-term care insurance.

A framework for analysing superannuation fund member outcomes in retirement was examined by Craig McCulloch, principal at Milliman, while Professor Piet de Jong, Macquarie University, explored the concept of super bonds as a means of managing mortality risk that could also solve the longevity funding crisis.

Kevin O’Sullivan, chief executive officer of UniSuper Management gave a considered and comprehensive perspective on running a large industry super fund, and the ways UniSuper meets the needs of its distinct but diverse membership base.

The conference, held on Friday 29 March, was opened by the Vice-Chancellor of Macquarie University, Professor S Bruce Dowton, and the co-directors of the Centre for Financial Risk, Professors Jeffrey Sheen, Pavel Shevchenko and Stefan Trueck.

The engaged audience showed strong interest in the innovative approaches by industry and university researchers to meet future retirement income requirements during both the formal sessions and more informally during the breaks.

The conference, in its ninth year, provided an important platform for novel approaches to dealing with serious and growing problems faced by governments, superannuation funds, the financial services industry and individuals grappling with ways to ensure stable and decent incomes in retirement.

Photos - Nick James Fraser.

If you hold digital currency, is it worth holding several smaller accounts to reduce the risk of theft of a larger account?

This idea will be explored in a seminar by Emeritus Professor Charles M Kahn, University of Illinois, who will present ‘Eggs in One Basket: Choosing the Number of Accounts’ on Monday 25 February 2019.

The joint seminar was arranged by the Department of Economics, Centre for Financial Risk and Department of Applied Finance at Macquarie University.

Digital currencies store balances using anonymous addresses and this seminar analyses the trade-offs between, safety and convenience of aggregating balances.

It becomes necessary to balance the risk of theft of a large account with the cost to safe-guarding a large number of passwords of many small accounts.

Account custodians, such as banks and other payment service providers, have different objectives and trade-offs on these dimensions. The analysis will consider the welfare effects of differing industry structures and interdependencies.

Prof Kahn’s research specialties are payment systems and liquidity. He is Professor Emeritus in the Department of Finance at the University of Illinois. He was previously Bailey Memorial Professor and as department chair, as well as co-director of its Office for Banking Research.

He is currently a Research Fellow at the Federal Reserve Bank of St. Louis and a Visiting Scholar at Bank of Canada.

An authority on banking and financial intermediation, Prof Kahn has been an overseas fellow at Churchill College, Cambridge University; a visiting fellow at the Australian National University; a National Fellow of the Hoover Institution, Stanford University; a Houblon-Norman fellow at the Bank of England; and the Visiting Tan Chin Tuan Professor at the National University of Singapore.

He consults regularly for central banks throughout the world and has been a visiting scholar at the Federal Reserve Banks of Atlanta, Chicago, and New York.

Time: Monday 25 February, 11:00am - 12:00pm

Register here

Gary was appointed Professor of Finance in the Faculty of Business and Economics in mid-2016, after a previous role as Professor and Director of HDR and Research in the Department of Finance, and also founding Director of the Centre of Business Research in China, at Deakin Business School. He was also former Professor of Finance and Director of Chinese Commerce Research Centre at Wollongong University. He has held various visiting professorships in universities in China such as Shanghai University of Finance and Economics, Southwestern University of Finance and Economics, and South China University of Technology.

Professor Tian has supervised more than a dozen PhD students. His research interests focus on corporate finance including political connections, CEO compensation, bank lending and informal finance, investment efficiency and family firm and audit opinions and auditor choice. Gary has published in leading finance journals such as the Journal of Corporate Finance (2011, 2012, 2013, 2015) and Journal of Banking and Finance (2015, 2016 and one paper in press). Last year, as one of CIs, he secured the only ARC Discovery Grant in the field of finance (2015-2017). He won a Best Paper Awards from the Financial Management Association in 2011 and Pacific Basin Finance Journal in 2015 and Emerald Citations of Excellence Award for 2015 for his authored paper published in Journal of Corporate Finance in 2012.

Financial Literacy Australia has awarded two grants to CFR members for projects that will directly help consumers better understand personal financial risks.

A grant of $120,000 has been made to Professor Stefan Trueck and a multidisciplinary team for “AntiPort – Educating the public on risks and the prevention of mobile number porting scams”.

The project draws on expertise within Macquarie University and the Optus Macquarie Cyber Security Hub with the involvement of Dr John Selby, Associate Professor Christophe Doche and Martin Boyd.

The project aims to assist consumers to protect their privacy and finances by improving mobile phone security through education and implementation of other measures to stop personal information being compromised and abused by professional scammers. The project addresses a rapidly growing problem, with many individuals facing significant financial loss and considerable difficulty in rectifying the identity problems that arise from porting crimes.

An additional $30,000 contribution to the project will be provided by the Optus Macquarie Cyber Security Hub.

A second grant by FLA has been awarded to Associate Professor Tim Kyng for ongoing work into retirement village costs and contracts. The project has received $90,000 in funding to investigate “The nexus between Retirement Villages and Aged Care”. It will explore the risk and costs of relocating from a retirement village to other accommodation, particularly to aged care, with analysis of industry practices that may limit aged care funding options.

The grant follows on from Dr Kyng’s previous FLA-funded project for the development of a Retirement Village Calculator to compare fees between villages. The second stage of the retirement village project will allow a deeper exploration of the true costs and broader implications of living at a retirement village.

This will include an evaluation of financial or other hardships that may arise because of delays in returning funds to the resident by the village, and whether the amount available for aged care or other accommodation options may be eroded by unexpectedly high fees levied on departure or other unfavourable contract terms.

Over the three-day programme, 23 papers were presented at the two venues. Highlights included presentations by Professor Yacine Aït-Sahalia from Princeton University on stochastic volatility implied models, Professor Jun Yu from Singapore Management University on bubble testing, Professor Xu Zheng from Shanghai Jiaotong University on Copula models, and Professor Sebastien Laurent from Aix Maseille University on the estimation of Beta.

The split event was a first for the Frontiers in Econometrics workshop, but resulted in useful informal interaction between participants as they travelled together, along with the chance for international guests on their first visit to Australia to appreciate two cities. Views of the Sydney skyline from Macquarie’s City Campus and dinner at Pyrmont were matched with breakfast on a bridge over the Brisbane River and Queensland’s University of Technology’s adjoining Gardens Point Campus, giving participants and opportunity to make the most of the host cities while enjoying the rigorous program.

The Frontiers in Econometrics workshop was hosted jointly between Department of Economics and The Centre for Financial Risk at Macquarie University, and Queensland University of Technology.

Researchers from Princeton University, Singapore Management University, Shanghai Jiao Tong University and Queensland University of Technology have previously hosted the event, and this year is the first time that Macquarie has played a key role in the joint conference between the five institutions.

The 2018 conference program is available at the National Centre for Econometric Research website:

http://www.ncer.edu.au/events/20180719-frontiers-in-econometrics.php

Organised and hosted by the Centre for Financial Risk and held in conjunction with the Journal of Commodity Markets, the Conference provided a forum for presenting and discussing high-quality research in all areas of economics and finance related to commodity markets. This year the conference had a special focus on risk management in power markets and the transition of electricity markets, renewable energy and stranded assets.

The Conference included a keynote speech by Jaime Cassasus (Catholic University of Chile) on ‘The Economic Impact of Oil on Industry Portfolios’ and several academic and industry plenary sessions, including presentations by Professor Mike Aitken (CEO, Capital Markets CRC), Alex Georgievski (Managing Partner, Woollahra Partners), Thomas Schmitz (Head of Sales – Global Commodities, EEX), Professor Martina Linnenluecke (Macquarie University) and Isham Nilar (Origin Energy).

There were over 40 international and national presenters and attendees. The conference program included presentations on a diverse field of research areas, including, among others, the dynamics of oil prices, modelling and risk management in electricity markets, investment and trading in commodity markets, renewable energy, energy consumption and growth, and the price behaviour of exotic commodities.

The conference chairs were Lurion De Mello and Stefan Trueck. The organising committee comprised Professor Martina Linnenluecke, Professor Marcel Prokopczuk, Professor Pavel Shevchenko and Professor Tom Smith.

The conference organisers would like to acknowledge and thank eeX, Woollahra Partners and Capital Markets CRC for their contribution to a very successful event.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.

End of slideshow

The 8th Financial Risk Day brought together experts from industry, academia and regulators to analyse and discuss recent developments in financial research. This year's theme was “Investment and Risk in the Low Interest Rate Environment” (conference organizers: Jeffrey Sheen, Pavel Shevchenko and Stefan Trueck).

The Centre for Financial Risk in the Faculty of Business and Economics hosted Macquarie University’s eighth annual Financial Risk Day on 16 March 2018 at the Sydney Swissotel.

There were 111 registrations, with approximately 65% of attendees from outside Macquarie University. There were seven high-calibre plenary speakers:

- Guy Debelle, Deputy Governor, Reserve Bank of Australia (RBA); "Risk and return in a low rate environment".

- John Pearce, Chief Investment Officer, UniSuper; "A practical look at risk and return in the current environment".

- Antje Bernt, Head of Finance, Research School of Finance, Actuarial Studies & Statistics, Australian National University; "Dealer Inventory, short interest and price efficiency in the corporate bond market".

- Simon Elimelakh, Head of Investment Risk and Portfolio Analysis, NAB Asset Management; "Style Matters".

- Alastair Sloan, Former Head of Asset Allocation at Sunsuper; "Trading markets in the low interest rate environment".

- Stephen Kirchner, Program Director, Trade and Investment, United States Studies Centre, University of Sydney; "Interest rates, monetary policy and financial stability".

- Nigel Wilken-Smith, Director, Portfolio Strategy, Future Fund; "Portfolio construction in a low rate environment".

Financial Risk Day is a key platform to exchange ideas on emerging research and regulatory issues on important risk-related topics, and to enhance links with industry and regulatory practitioners.

Please visit our website for further information on this years’ Financial Risk Day event.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.

End of slideshow

Before his appointment, Prof Shevchenko was a research scientist at CSIRO Australia where he had been since 1999. From 2012 he had held the position of a Senior Principal Research Scientist.

At the CSIRO, Pavel worked in the area of financial risk, leading research and industry commercial projects on modelling of operational and credit risks, longevity and mortality, retirement products, option pricing, insurance, modelling commodities and foreign exchange, and the development of relevant numerical methods and software. He received a MSc from Moscow Institute of Physics and Technology in 1994 and a PhD from The University of New South Wales in 1999.

Pavel is currently an Adjunct Professor at the University of NSW, adjunct Professor at University of Technology Sydney, and Honorary Senior Research Associate in University College London. He is also associate editorof international journals (RISKS and Journal of Operational Risk) and member of a retirement incomes working group at the Institute of Actuaries of Australia. He has published extensively in academic journals, consults for major financial institutions and is a frequent presenter at industry and academic conferences. His publication records include one research monograph, two co-authored research monographs, more than 60 journal papers and over 80 technical reports.

Organised and hosted by the Centre for Financial Risk, the Conference provided a forum for presenting and discussing high-quality research in all areas of economics and finance related to commodity markets, with an emphasis on – but not limited to – the Australasian aspects of commodity markets and energy risk.

Held in conjunction with the Journal of Commodity Markets, the Conference included keynotes by Marcel Prokopczuk, Professor of Finance at Leibniz University Hannover, Germany, and a double plenary with speakers Thomas Schmitz, Director EEX Group Sales - Global Commodities and Chief Commercial Officer of eeX in Singapore, and Professor Graham Town, from the Department of Engineering at Macquarie University.

There were over 40 international and national presenters and attendees including the Chief and Deputy General Managers of the Securities Exchange Board of India. The conference program included papers on gas and agricultural markets, trading strategies, risk management and premiums, and hedging and derivatives, all from an Australasian perspective.

The conference organisers Professor Stefan Trueck and Dr Lurion De Mello would like to acknowledge and thank the inaugural Australasian Commodity Markets Conference Sponsors: eeX, Woollahra Partners and AFAANZ for their contribution to a very successful event.

The Centre for Financial Risk in the Faculty of Business and Economics hosted Macquarie University’s seventh annual Financial Risk Day on 17 March 2017 at the Sydney Swissotel.

Risk Day is an event held each year by Macquarie University's Centre for Financial Risk to showcase work by researchers in this multi-disciplinary centre while enhancing links with industry and regulatory practitioners. Risk Day is a key platform to exchange ideas on emerging research and regulatory issues on important risk-related topics.

This year’s theme - Impact of Technological Innovation on Financial Risk – brought together experts on Blockchain, Cryptocurrencies, Data Analytics, and the current wave of FinTech to examine the impact of these developments on the finance and insurance sector, economic and social exposure, and potential gains.

This year was also the first time the Centre partnered with the Optus Macquarie University Cyber Security Hub to profile cyber security as a cross-cutting theme. This provided opportunities to discuss how industry, government and universities are collaborating to develop resilience of cyber security for business and society.

Sessions themes included:

- Risk management issues related to Fintech and digital currencies

- Innovations and risk modelling in cyber security

- Impacts of the blockchain on financial markets and institutions

- Digital banking services

- Risk fundamentals for successful peer-to-peer lending

Financial Risk Day 2017 brought together representatives of industry, academia and regulatory bodies including:

- David Yermack, cryptocurrency expert - New York University

- Piet De Jong, Professor of Actuarial Studies - Macquarie University

- Fergus Brooks, National Practice Leader, Cyber Risk – AON

- Simon Schwartz, Executive Director - Adexum Capital Peer-to-Peer Lending

- Mike Aitken, CEO, Professor and Chief Scientist - Capital Markets CRC

- Pete Steel, Executive General Manager, Digital - Commonwealth Bank of Australia

A half-day workshop on this topic, along with a second presentation on a liability-relative drawdown approach to pension asset liability management, were delivered as part of a separate event at Macquarie Applied Finance Centre attended by more than 35 people, largely from industry, on 24 November.

Panel discussions followed each session and involved Frank Ashe, Honorary Fellow MAFC; David Bell, Chief Investment Officer, Mine Wealth and Wellbeing Super Fund; Simon Russell, director of Behavioural Finance Australia and Steve Christie, Director and Principal of ACD Financial, along with Associate Professor Peter Vann, MAFC, as moderator.

The additional campus workshop, attended by almost 20 participants, was held on 1 December 2016 at the Experimental Lab at MGSM and was targeted at PhD students. It explored attitudes to risk and uncertainty as a key component of most economic models and examined developments in the past two decades in methods to measure these preferences in the lab and in the field, and ways of improving outcomes through careful design and implementation of models.

The workshop reviewed some of the standard methods for measuring risk attitudes commonly applied in the literature. It also looked at a relatively new strand of literature involving measuring people’s attitudes to ambiguity where decision problems arise because the probabilities of outcomes are not known, or “unknown unknowns”.

Roy is also director of the PhD Program at Mahidol University’s College of Management in Bangkok. Roy received his PhD in Finance from Erasmus University Rotterdam in the Netherlands and he is a CFA charterholder. Prior to joining CMMU, Roy held positions as quantitative analyst at AEGON Asset Management, The Netherlands, as a postdoctoral fellow at the University of British Columbia, Canada, and as assistant professor at the Asian Institute of Technology, Thailand. He is a visiting researcher at the Erasmus School of Economics, The Netherlands.

Dr Kouwenberg’s research areas are investment and behavioural finance. His main focus is on behavioural portfolio choice, especially the impact of loss aversion and ambiguity aversion on stock market participation. He has also done extensive research on financial risk management, especially asset-liability management for pension funds and insurance firms.

Dr Kouwenberg has published his work in the Journal of Financial Economics, Management Science, the Journal of Financial & Quantitative Analysis and the Review of Economics & Statistics, amongst others. He is an editor of the Journal of Pension Economics and Finance, published by Cambridge University Press. He has refereed articles for the Journal of Finance, Review of Financial Studies, American Economic Review and Econometrica.

Summary

Centre for Financial Risk's PhD Workshop, Semester 2, 2017

Our PhD workshop is organized by the Centre for Financial Risk and will be held on Monday, the 6th November 2017. PhD students from the Department of Applied Finance and Actuarial Studies and the Department of Economics will be presenting their working papers. As usual, presentations are 25 minutes followed by a short presentation/review of the paper by a discussant (internal or external expert in the area who reviewed a working paper before the workshop) and a general discussion. The objective of the workshop is to provide a feedback to PhD students on their research and to improve working papers for submission to peer-reviewed journals. It is also a good training for PhD students in presenting their research and an opportunity for others to see the research of our PhD students. Below is the list of presentations.

Student: Johan Andreasson

Supervisor: Professor Pavel Shevchenko

Discussant: Dr Sachi Purcal

Title: Optimal annuitisation, housing decisions and means-tested public pension in retirement

Student: Yanlin Li

Supervisor: Professor Gary Tian

Discussant: Dr Anna Loyeung - UTS

Title: Are the independent directors recommended by their predecessors indepSpendent? Evidence from China

Student: Yanling Wu

Supervisor: Professor Gary Tian

Discussant: Dr Le Zhang - UNSW

Title: Media Coverage and Initial Public Offering, Based on the Rent-seeking Perspective: Evidence from China

Student: Jin Sun

Supervisor: Professor Pavel Shevchenko

Discussant: Professor Ken Siu

Title: A note on the impact of management fees on the pricing of variable annuity guarantees

Student: Qin Zhang

Supervisor: Professor Jeffrey Sheen

Discussant: Dr Ben Wang

Title: Does Use of the Mixed Frequency and Unbalanced Data Provide Gains for Forecasting? Evidence from China’s macroeconomy

Student: Matteo Malavesi

Supervisor: Professor Stefan Trueck

Discussant: TBA

Title: Pareto Optimal Choices vs Mean Variance Optimal Choices: a Paradigm of Portfolio Theory

Contact: Ms Candice Langdon, Project Officer, 9850 8533

Event location: Finance Decision Lab, Level 1, Building E4A

Event Details / Program

Date: Monday 6th November 2017

Time: 1.00pm-5.00pm. Light refreshments will follow

Location: Finance Decision Lab, Level 1, E4A