2022 events

Financial Integrity Hub's 2022 events

See information about all past Financial Integrity Hub events.

International Anti-Corruption Day

In a collaboration between the Financial Integrity Hub (FIH) and the British Consulate General Sydney, this event featured an address from Nick Crouch, British Deputy High Commissioner to Australia and Senator David Shoebridge, member of the Joint Select committee on National Anti-Corruption Commission legislation.

The event also featured a panel discussion with Vafa Ghazavi - Executive Director, Research & Policy, James Martin Institute for Public Policy; Dr Hannah Harris - Financial Integrity Hub and Macquarie Law School, Dr Daley Birkett - Financial Integrity Hub and Macquarie Law School, and Nathan Lynch - Thomson Reuters and the author of “The Lucky Laundry”, examining efforts to combat corruption and illicit finance in Australia and overseas.

See our image gallery below.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.

End of slideshow

Considering Tranche II – Financial Crime and Gatekeepers

In its final event for the year, the Financial Integrity Hub, in collaboration with the Israel Business Club Sydney, marked International Anti-Corruption Day by bringing together industry professionals, academics, and government to raise awareness on financial crime.

The failure to implement Tranche II reforms is universally understood to be a major problem with Australia’s anti-money laundering and counter-terrorism financing regime. That is, the failure to define Lawyers, Accountants, and Real Estate Agents as designated services with reporting obligations.

With an address from the Honourable Natalie Ward, Minister for Women's Safety and the Prevention of Domestic and Sexual Violence, this event also featured insights from keynote speakers Timothy Goodrick - Director Forensic at KPMG, Edward Kitt - Illicit Finance Lead at British High Commission Canberra, and Milan Cooper, CEO at First AML.

See our image gallery below.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.

End of slideshow

Financial Crime and the Cyber Dimension

Cybercrimes include a broad range of criminal activities that are related to the use of information technologies for unlawful objectives. Cybercrimes includes online crimes such as unauthorized access to users’ confidential data, online frauds and misdirection of communications, money laundering and hacking.

The Financial Integrity Hub (FIH) is hosting a seminar on Financial Crime and the Cyber Dimension. The event will feature keynote speakers John Baird – Adjunct Fellow at Macquarie University, previously Chairman of the Cyber Security Advisory Council (NSW department Finance, Services and Innovation); Ben Scott - Executive Manager, Financial Crime Intelligence Unit, Commonwealth Bank of Australia; and Nikki Eylon - General Manager Oceania at BSW Group.

Check out a video of the event as well as our image gallery below.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.

End of slideshow

Blockchain Intelligence: Cryptocurrency De-Anonymisation

Cryptocurrency is an emerging and disruptive technology that provides alternatives to traditional financial services offered by regulated financial institutions. It also poses money laundering and terrorist financing risks. Money laundering and Terrorist financing involves two primary activities: sourcing and distributing funds. Cryptocurrencies, made possible through blockchain, provide a highly effective method of doing both.

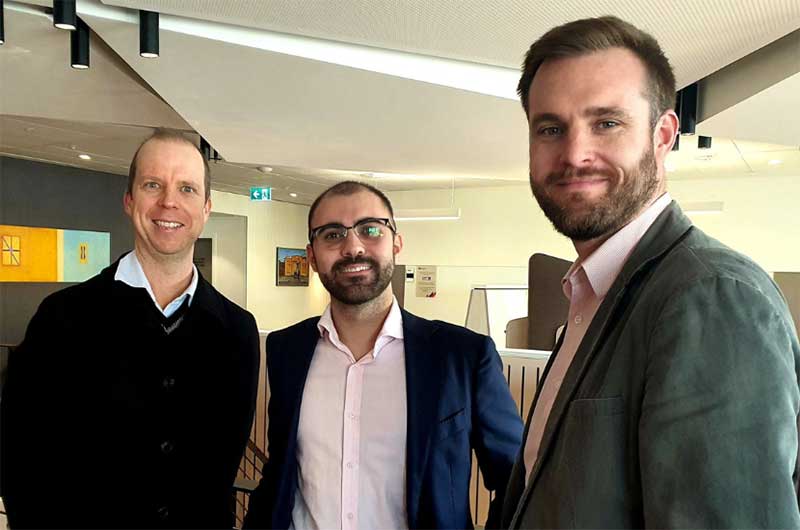

The Financial Integrity Hub (FIH) hosted a stimulating, collaborative seminar on ‘Blockchain Intelligence: Cryptocurrency De-Anonymisation’. Lise Waldek from the Department of Security Studies and Criminology at Macquarie University started the discussion on far-right extremism and finance. Financial Crime Lawyer and Senior Advisor at Norton Rose Fullbright Australia, Jeremy Moller, shed light on the regulatory regime and the financial crime risks involved with using crypto. Gilad Ben-Ari, CTO at Cognyte, shared Cognyte’s solution to the risks considered in the session.

See our image gallery of the event, below.

Slideshow presentation

The following slideshow can be cycled through displays. Depending on screen reader and browser combination, they may present one at a time or all at once. Additionally, when the slideshow has keyboard focus, the left and right arrow keys can also be used to navigate the slides.