Research Findings, Business and Economics, Macquarie University

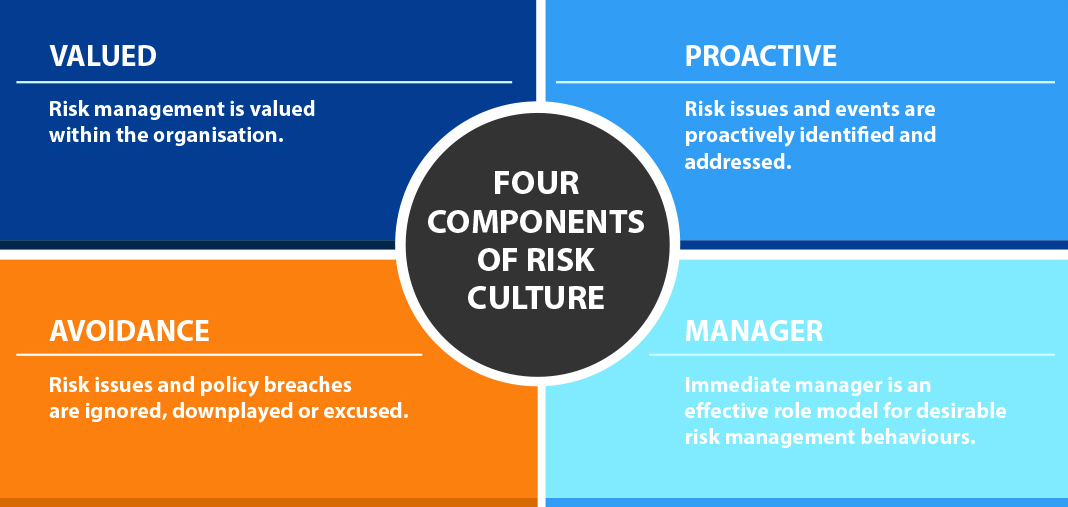

Our research has identified four factors or component of risk culture, shown below. Note that three of the four are desirable while one, Avoidance, is considered undesirable. You can download a paper with our research findings.

Part of the validation process is to demonstrate how risk culture relates to risk behaviour of employees. We collect information about risk behaviour using the Macquarie University Risk Behaviour ScaleTM. This questionnaire asks employees to comment on their own behaviour with regard to risk management and also on the risk-related behaviour observed across their business unit. We found, for example, that desirable risk behaviour is reported more frequently when culture is strong on the dimensions of Valued, Pro-Active, Manager. The Avoidance dimension of culture is associated with higher undesirable risk behaviour (both self-reported and observed in the business unit). In addition we found that certain characteristics of the individual staff member help to explain behaviour such as tenure, personal risk tolerance and personal attitudes to risk management. Someone who believes that risk management is an unnecessary impediment to doing business (for example) is more likely to self-report undesirable risk behaviour. Similarly someone who is risk tolerant in their personal choices is more likely to self-report undesirable risk behaviour. Someone with long tenure is more likely to self-report desirable risk behaviour.

Submission to the Basel Committee for Banking Supervision: Corporate governance principles for banks October 2014 (PDF)