ALUMNI FOCUS

More than numbers

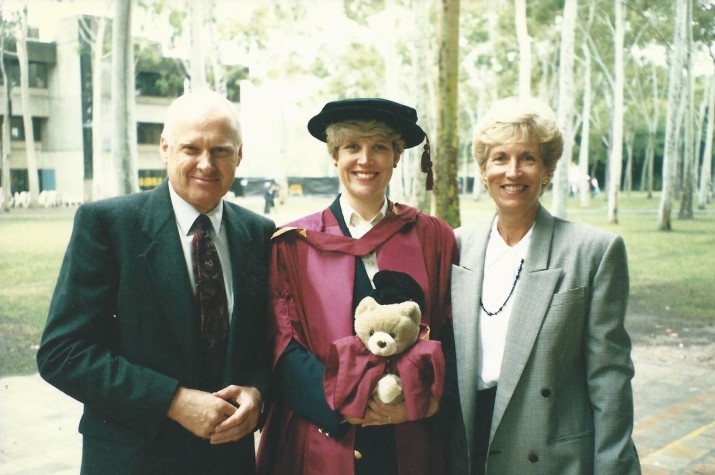

When Professor Elizabeth Sheedy from the Master of Applied Finance program first joined MQ in 1993 as a lecturer and PhD student, fresh from the youthful cohort at Macquarie Bank, little could she have known she would still be here 30 years later. Nor could she have foreseen that her father, husband and daughter would also study here. But, talking to her, it all makes perfect sense. You could say, it all adds up.

‘It seems like a long time, 30 years!’ laughs Professor Elizabeth Sheedy, immediately putting me at ease. (Finance isn’t my strong suit but, as I’m about to discover, there’s more to it than meets the eye and, even more pertinently, we can all improve our financial literacy and wellbeing.)

‘It’s funny having been in the one workplace for so long,’ she continues. ‘There have been different deans, different ways of doing things. In fact, I don’t think there are many people in the business school who’ve been here longer than me – I’ve outlasted them all!’ she jokes.

Then, more thoughtfully: ‘Teaching in the Master of Applied Finance for 30 years has been a privilege; it’s been great,’ she says warmly, and you quickly get the sense she’s grounded in the real world, much like her teaching and research. So, is that what’s kept her at MQ for so long?

‘Absolutely, it’s the applied focus at Macquarie,’ says Professor Sheedy straight off the bat. ‘The way finance is taught at a lot of other unis and the style of research undertaken, it’s just really theoretical, which is strange because we’re not teaching philosophy! Finance is a very practical discipline, yet it’s often completely disconnected from the industry.’

Maintaining industry connections is something Professor Sheedy has worked hard at and given a high priority over the years. As she explains, ‘We only teach professionals in the Master of Applied Finance, so the program has always had to reflect the rapidly changing industry – it’s given me a unique, industry-focused approach to research.’

For example, from 2012–2022, her research centred on the culture and remuneration practices of financial institutions as she and her co-authors worked to understand and find solutions to some of the terrible experiences of customers that came to light during the Royal Commission into Misconduct in Financial Services. ‘This research has given me many opportunities to present findings to industry audiences and appear in the media, helping to change industry practices,’ she says.

She goes on to note, ‘Macquarie has been an environment where my approach has generally been supported. Many other universities, with a more theoretical focus, wouldn’t have given me that support. I hope Macquarie Business School can continue to have this applied focus, despite the pressure for A* journal papers.’

It was also this industry focus that drew her to Macquarie University in the first place. She remembers, ‘The 1980s and 90s were a time of tremendous growth and change in the financial services industry with the deregulation of markets. Hundreds of people with accounting and economics degrees wanted to learn about finance and join this exciting industry.

‘Macquarie started the Master of Applied Finance in the 80s to meet this demand. It rapidly became the post-grad degree of choice because it was taught by people with industry experience rather than career academics.’

With more than ten years of relevant experience and one of the first to have formally studied finance as part of her undergrad degree, Professor Sheedy was invited to join the MQ teaching team in 1993. She left behind a rewarding role at Macquarie Bank to pursue her passion for teaching and research, explaining, ‘I wanted the intellectual stimulation and freedom to do things that are interesting or important, rather than making a bank a lot of money.’

It was a busy time for her, as she was also studying part-time for her PhD at Macquarie while lecturing full-time. ‘People thought I was taking a break from the intensity of a bank to work in a university, but the opposite was true; it was a very busy time!’

In fact, the Masters of Applied Finance program became so successful it was offered in Melbourne, Brisbane, Perth, Singapore, Hong Kong, Tokyo, Beijing and Shanghai (as well as Sydney) at various times. ‘With over 5,000 alumni, my colleagues and I have educated a whole generation of finance professionals who have gone on to become leaders of the industry,’ she notes. ‘It has been tremendously exciting to be part of this experience and, to this day, we remain the #1 ranked program of this type in the Asia-Pacific region.’

Still, you get the sense it’s not the accolades she’s after. ‘I just love teaching and research; the academic life is for me,’ she says. ‘I can’t think of any other job I’d prefer. The great thing about university life is my research topics keep changing, which allows me to grow and learn about something completely new.’

Currently co-leading a significant project sponsored by a major Australian bank to investigate the financial decision-making of young adults, Professor Sheedy explains, ‘The overall theme is financial wellbeing. It’s just so interesting looking at the challenges this generation is facing, such as home ownership and the cost of living.

‘MQ puts a strong emphasis on a multidisciplinary approach, so we have psychologists and anthropologists, for example, bringing in different perspectives. We’re still in the early stage of the project, but it’s really worthwhile and very important to society as a whole.’

Not convinced young adults have given up on the Australian dream just yet, Professor Sheedy says, ‘It may just happen further in the future for this generation – a home is a massive investment, but it also gives people a lot of safety and security.’

She also suggests the cost-of-living challenge reflects people’s ability to adapt. ‘It’s part of life that you’ll get a financial shock from time to time; we can’t eliminate that,’ she acknowledges. ‘But people with financial resilience are good at adapting to that shock – they’re good at cutting back on discretionary expenses, making changes to their lifestyle, for example. We want to understand why some people can adapt better than others.’

It’s a topic Professor Sheedy was invited to speak on at the recent MQ Young Alumni event, where she captivated the audience with her insights. ‘Financial literacy is closely linked to numeracy, educational attainment and familial experiences,’ she explains, and coming from a family where money and investments were openly talked about, it’s something she knows firsthand.

‘I enjoyed maths and economics at school, and we talked about money and investments at home. My dad and uncle made some interesting investments, which were not exactly mainstream; I thought it was really interesting.’

Still, it’s not just an interest in finance she and her family has in common. ‘My father was also an academic, and after he retired, he decided to do an arts degree at Macquarie. He did it slowly, one subject a semester, but managed to finish it before his 80th birthday.’

Her husband also completed his MBA at MQ, graduating in 2016, and her daughter has recently finished her Bachelor of Psychology. ‘Between the four of us, we have lots of Macquarie experience!’ she laughs, noting her daughter also went to Banksia Cottage when she was small and often visited the campus as she was growing up.

So, what would be her financial advice to her daughter and, by extension, other young adults? ‘Start putting money away as soon as you can for longer-term goals; try not to live in the moment. There’s a lot of enjoyment in life that doesn’t require money, and the thing with living in Sydney is you can go to the beach, go bushwalking, there’s a lot that’s free –you’ll be healthier and have the advantage of saving money.’

And that’s advice we can all take something from.

Interested in Macquarie University’s Master of Applied Finance? Delivered by industry experts focusing on real-world finance, we’re #1 in Australia and in the top 50 globally (QS Business Masters Ranking, 2022). Further your career in the global financial environment with MQ and get in touch today.

Professor Elizabeth Sheedy is a risk-governance expert in the Department of Applied Finance of Macquarie Business School. She is also on the board of the Governance, Risk and Compliance Institute and an active member of the Risk Managers’ Association of Australia.

In 2021 she published her first sole-authored book Risk Governance: Biases, Blindspots and Bonuses with Routledge. She also publishes in top international journals and is an Associate Editor for the Journal of Banking and Finance, rated A* by the Australian Business Deans’ Council.

Professor Sheedy teaches students in the MBA, Global MBA and Master of Applied Finance programs and is the unit convenor for AFCP8103/MMBA8148 Risk Measurement and Management as well as GMBA8034 Manage the Risks. She also supervises PhD and M.Research students with an interest in risk management and governance.

Her multi-method, multidisciplinary approach has produced several groundbreaking findings in the field, including the development of the Macquarie University Risk Culture Scale, and her work has been enhanced through industry collaboration. Professor Sheedy is a popular speaker at industry conferences and a regular media commentator.

I am delighted to know that Professor Sheedy was the one who taught me in MaAppFin Program in Singapore where our batch graduated in 1996. At that time, it was a program jointly with Institute of Banking and Finance (IBF) Singapore. Probably we were the 2nd batch of students. it was a tough program where a number of students dropped out. Finally, out of the class of about 30, only about 18 of us graduated in 1996. Had good and fond memories of Prof Sheedy flying in from Sydney to conduct our tutorial and lectures. Congrats to Prof Sheedy on her commitment in education especially in Applied Finance programs. All the best and good health to Prof Sheedy.

Hi Victor, thank you so much for your comment, I will pass it to Prof Sheedy and I’m sure she’ll be delighted to hear this. Thank you!

Kind Regards,

Yue

Alumni Relations Coordinator