A bold new world: rethinking finance

By Jen Waters

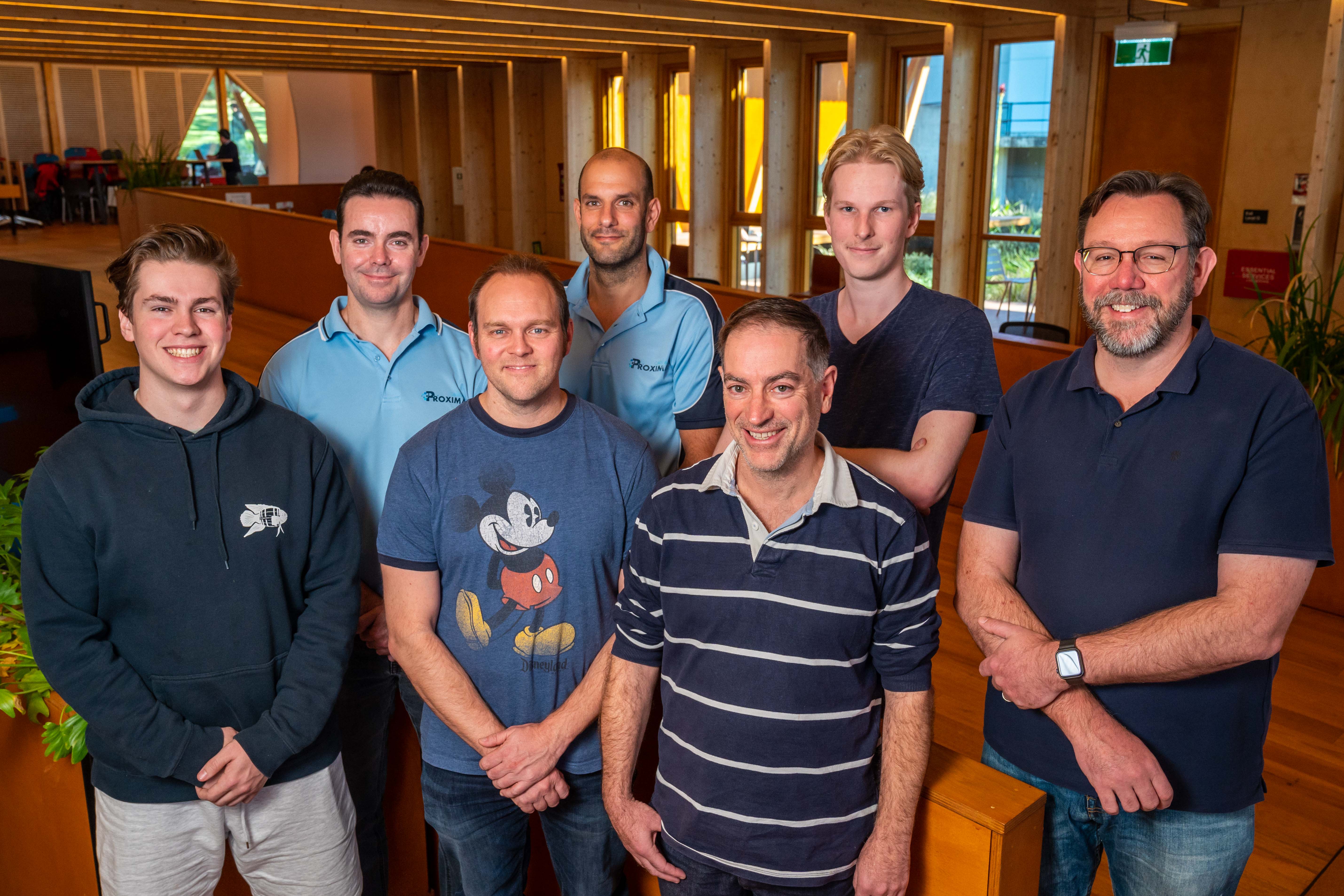

Proxima Capital’s prodigious success goes far beyond simply being in the right place at the right time. The confluence of the extraordinary vision and deep experience of its co-founders, Bernard Orenstein and Oliver Chalk, has placed the startup on the frontlines in building the new financial system.

Sitting at the intersection of funds management and tech, Proxima is a trading firm focused on market-neutral strategies in cryptocurrency markets. At its core is a fully automated market-making and arbitrage system that enables it to exploit inefficiencies in crypto markets globally – simultaneously buying and selling cryptocurrencies across different platforms for profit.

Orenstein had been trading in more conventional financial markets for more than two decades when his son asked him to help him invest in the cryptocurrency Ethereum in early 2017. Keen to learn more about the space, he ended up investing himself, then arbitraging, finding the consistent returns a welcome respite from the volatility of traditional trading.

“This was just before crypto’s bull run in late 2017; it went crazy, and I sort of fluked the top. So I began arbitrage – buying bitcoin for US dollars and selling it instantly for Australian dollars at a two per cent profit,” Orenstein recalls.

“Eventually, the ability to do that manually dissipated, and I thought: what if we could build a computer program that could automate this and chase those opportunities 24/7?”

He reached out to his network and met co-founder and crypto wunderkind Oliver Chalk – the son of a friend of a friend, then just 18 years old and 35 years Orenstein’s junior – and the idea took flight. The pair kicked off an international crypto mining operation in Alabama with Chinese-sourced mining hardware, but talk kept returning to the arbitrage concept, and their path became apparent.

Chalk built the minimum viable product (MVP) automated arbitrage system in just two weeks, and it hasn’t stopped making money since.

“This year, we’ve built our fund up from zero to around US$40 million under management, and next year we’re looking to grow that to the hundreds of millions. In the past 18 months, we’ve also gone from just the two of us to a team of 22, half of which are based overseas.”

Exploiting those differences through arbitrage also has the added effect of bringing prices between fragmented global markets back into equilibrium. This, in turn, creates a more level playing field for all investors and traders globally, including those in developing nations who would generally be trading at worse prices than their counterparts on larger exchanges in major financial centres such as London and New York.

Proxima has recently graduated from the Macquarie University Incubator program, having reaped the rewards of residency since early 2018. The company has just moved into a North Sydney office suite with sweeping harbour views, serving as the base for the next stage in its growth.

“Establishing overseas trading operations is essential to growing substantially and attracting more international investors,” explains Orenstein.

“We’re launching our fund in Bermuda in January, and Oli has just moved to the Cayman Islands to establish and run our business operations there as part of the Cayman Economic City hub for crypto funds and blockchain and tech firms.”

It’s an exciting step into the future of finance, steered by Chalk’s youthful vision and tech talent, Orenstein’s industry pedigree, and a commitment to their shared values of courage, trust and truth-seeking.

“What we’re doing in crypto is building the whole new financial system; it’s eating the old financial system up. People talk about traditional finance and crypto, and there is a separation at the moment. But within five or ten years, there will only be one financial system with its foundation in blockchain technology. That’s where it’s all heading.”